In This Article:

When you put your hard-earned money into something, you expect it to pay you back, right? That's where ROI comes into the picture. It's all about figuring out the profit for your investment.

Imagine tossing your cash into stocks, real estate, or a savings account for your golden years. Now, let's bring solar energy into this mix.

Sure, you might have thought about solar panels to cut down your electricity bills, or to reduce your carbon footprint—both admirable goals, no doubt. But how about viewing solar energy as a financial investment? Just like those traditional options, solar energy could give you a pretty sweet ROI. Let's shine a light on how this ROI game applies to solar energy.

Highlights In This Article

Solar panels offer an attractive return on investment (ROI) due to savings on electricity bills, enhanced property value, and tax benefits.

When compared to traditional investments like stocks or real estate, solar provides steady, increasing returns with less risk.

Investing in solar energy provides protection against rising energy costs and offers sustainability benefits.

Various financing options, including loans and solar rebates, make investing in solar more accessible.

Solar energy is a superior choice due to its renewability, sustainability, and contribution to energy independence.

Solar Investments and ROI

When you hear "solar energy," what springs to mind? A green planet, perhaps? Savings on your electric bill? True, but let's peel back the layers... Because solar, my friend, is much more than an eco-friendly choice—it's an investment.

Here's the deal. When you go solar, you're splashing some cash upfront. You're covering costs like buying the panels, getting them perched on your roof, permitting, and, of course, the occasional maintenance to keep everything running smoothly for the next 25 to 30 years.

But don't let that initial cost spook you. Remember, you'll also be benefiting from incentives and rebates that can trim down that initial outlay.

Your solar investment cost? It's the total dough you've spent, minus any incentives and rebates.

And here comes the interesting part—your return. Over the next few decades, while the cost of living (and, yep, electricity) is busy climbing, your electricity bill is comfortably soaking up the sun, not sharing in that uphill journey. Your solar panels, they're shielding you from the bite of electricity inflation, which often outpaces general inflation. You'll be basking in the glow of savings that could run into tens of thousands.

Give it around 8.8 years, on average. That's your payback period. After that? It's pure sunshine and savings, baby.

Deciphering Your Solar System's ROI: A Simple Calculation

Now, let's get down to the numbers part: calculating your solar system's ROI. You might be thinking, "How am I going to wrestle with all these numbers?" Don't worry—We've got your back!

Say you use roughly 900 kWh of electricity monthly, and that sets you back about $150. Based on this, you'll need around an 8 kW system to offset the majority of your electricity usage. Suppose the cost per Watt in your region is $2.76; with an upfront purchase, your total expense would come to $16,339 (factoring in the 26% tax credit).

Solar panels tend to last 30+ years, but manufacturers often cover the warranty for about 25 years, so we'll roll with that. To crunch the ROI numbers, you'll need to consider how much of your electricity your solar system covers, the degradation stipulated in your warranty, the term length of the warranty, and your local electricity inflation rate.

So let's consider this:

Your solar system covers 96% of your electricity consumption

Your solar panels are warrantied for 25 years

The warranty indicates your panels will degrade a maximum of 2% after year one, and no more than 0.5% yearly until year 25

The electricity inflation rate is 2.2%

Bring all these factors together, and by year 25, your solar system will still be covering approximately 82% of your electricity needs. Without solar, your electricity bill would be around $253 monthly—a whopping 69% increase from your current costs! In total, by year 25, you will have saved about $55,767 in dodged electricity costs.

You've invested $16,339 into your system and saved $55,767 over its warranty period, resulting in an ROI of 241.31% over 25 years. Now that's what I call seeing the light!

Solar ROI: A Brighter Bet Than Other Investments?

Now, you might be asking, "How does solar's ROI hold up against other types of investments?" Well, let's dive into it.

Solar is a long-term investment. To truly understand its value, consider the average annual ROI over its 25-year warranty period. But, let's not examine solar in isolation. Comparing its ROI to other investments, say the S&P 500 or real estate, can provide valuable context.

Forbes suggests a 7% ROI (after inflation) as a solid benchmark for a good investment, akin to the S&P 500—an index representing heavyweight companies like Microsoft and Amazon. But here's the kicker: stocks, albeit having higher return potential over the 30-year lifespan of a solar system, are also peppered with risks due to market volatility.

On the flip side, you've got bonds and certificates of deposit (CDs)—safer bets, akin to solar, but often yielding lower returns over time. We could look at a 5-year CD, a kind of deposit with a bank offering a fixed interest rate, or a U.S. 10-year Treasury bond, a loan to the federal government that earns you a fixed interest until maturity.

It's clear that the investment landscape is vast and varied. If you're game for a gamble in the short term, the S&P 500 might catch your fancy. But if it's safety and long-term yields you're after, solar emerges as a compelling contender—yielding substantial electricity bill savings and an effective hedge against inflation.

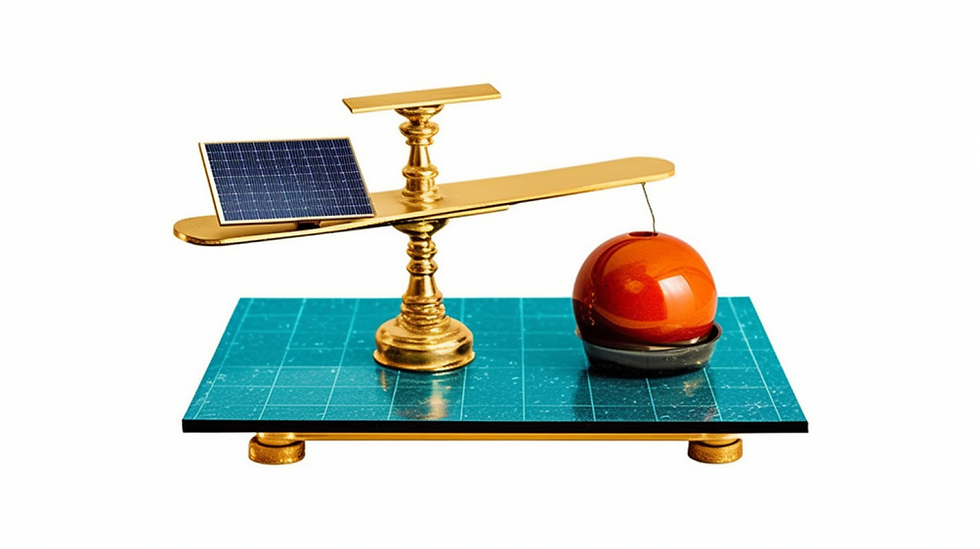

What's the moral of the story? When weighing your investment options, don't forget to put solar on the scales.

Solar: A Brighter Path for Your Investment Journey

The key allure of solar investment? Assured returns. Unlike the stock market that fluctuates daily with global events, solar remains steadfast. Pandemics, oil price hikes—these curveballs won't impact your solar earnings. The only event you'd need to worry about? A sunless world. So, as long as the sun's around, you're set for a sunny ROI.

Sure returns

What's more, solar offers a steady, rising tide of returns. As your warrantied system harnesses sunlight year after year, it continually generates electricity—translating to a consistent, growing revenue stream.

Tax-Free

Another major perk? It's tax-free! With solar, your gains aren't earnings, they're savings—hence, not taxable. In contrast, traditional investments can suffer under the weight of capital gains tax and income tax, but with solar, every penny saved is yours to do with as you please.

Inflation Hedge

Solar also acts as a buffer against rising electricity costs and inflation. Consider this: utility electricity rates jumped by 30 percent between 2010 and 2020. Investing in solar equips you with a defense against such unpredictable hikes. By generating your own electricity, you can sidestep volatile fuel sources like oil and evade peak rate charges.

Increased Home value

Finally, solar brings along another sweet deal—boosting the value of your assets. Research shows that going solar can enhance your home value by an average of 4.1 percent. That's an extra $9,000 in your pocket, on average. In fact, California has a new mandate for most newly constructed houses to be equipped with solar panels. Plus, coupling solar with a battery insulates your home and appliances against blackouts—protecting you from equipment damage and productivity loss.

So, is solar a better investment? Based on the evidence, it certainly has a good shot at outshining others.

Financing Your Solar Investment

Solar loans are a fantastic place to start. With competitive solar loan rates, these make it possible to own your solar system outright while spreading the cost over manageable monthly payments.

And don't forget about solar rebates and incentives. They're here to sweeten the deal. From the federal to the state level, these incentives can significantly slice down your upfront solar costs. Every little bit of savings counts, doesn't it?

However, all solar companies are not created equal. It's essential to compare the best solar companies before plunging in. Look at their track records, warranties, and customer service. A bit of due diligence today could save a lot of solar headaches tomorrow.

Ready to switch on solar savings? What's holding you back? Remember, solar panels aren't just an investment in your home—they're an investment in your future. Get a quote and start soaking up the sun—and savings—today.

FAQ

Is solar energy better than other sources?

Solar energy is indeed superior to many other sources. It's renewable, sustainable, and non-polluting. Plus, it reduces dependency on fossil fuels and contributes to energy independence.

Are solar a good investment?

Why is solar the best choice?

What is more efficient than solar panels?

Comentários